Malaysian Income Tax Relief 2018

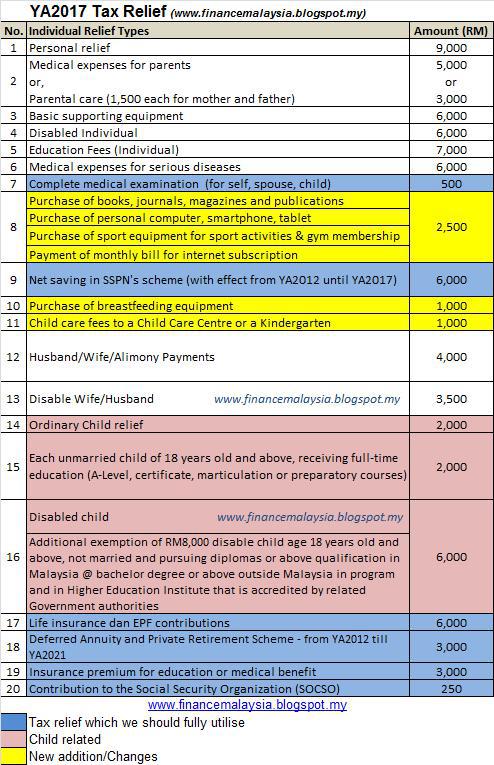

These are for certain activities that the government encourages to lighten our financial loads.

Malaysian income tax relief 2018. During this period many people will scramble to find the receipts of the items they purchased. This relief is applicable for year assessment 2013 and 2015 only. From year of assessment 2020 not applicable for 2019 2018 2017 couples seeking fertility treatment such as in vitro fertilisation ivf intrauterine insemination iui or any other fertility treatment approved by a medical practitioner registered under the malaysian medical council mmc can also claim under this income tax relief in malaysia. Rm5 000 medical expenses for parents or.

Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. Personal tax reliefs in malaysia. Companies are not entitled to reliefs and rebates. 2018 2019 malaysian tax booklet 7 scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope.

Income attributable to a labuan business. However if you claimed rm13 500 in tax deductions and tax reliefs your chargeable income would reduce to rm34 500. Refer to this list of the income tax relief 2018 malaysia. The conditions of entitlement for each relief must be satisfied in order to minimize the income tax liability.

Medical expenses for parents. For income tax malaysia tax reliefs can help reduce your chargeable income and thus your taxes. This would enable you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay from rm1 640 to rm585. Relief of rm5 000 is claimable for medical special needs or care expenses for your parents or parental tax relief if medical expenses for parents were not claimed children are entitled to collectively claim up to a maximum rm1 500 for each parent mother and father.

5 000 limited 3. Tax reliefs are set by lembaga hasil dalam negeri lhdn where a taxpayer is able to deduct a certain amount for cash expended in that assessment year from the total annual income. Rm9 000 in individual tax relief rm5 940 in epf contribution tax relief 11 of rm54 000 which is rm5 940 combining both taxable income and tax reliefs together the amount will arrive at. Now every individual in malaysia who is liable is required to declare their income to the inland revenue board of malaysia lhdn annually.

Reliefs are available to an individual who is a tax resident in malaysia in that particular ya to reduce the chargeable income and tax liability. The previous laptop books stationary and sports equipment tax relief is now grouped under lifestyle tax too.