Life Insurance Dan Epf Including Not Through Salary Deduction

Deduction is not allowed on premiums paid for life insurance policy contracted on the life of the child.

Life insurance dan epf including not through salary deduction. Yes employees provident fund epf is a part of 80c deduction. Pensionable public servant category life insurance premium ii. Life insurance and epf including not through salary deduction. You can claim for income tax relief for life insurance premiums on your own life or the life of your spouse.

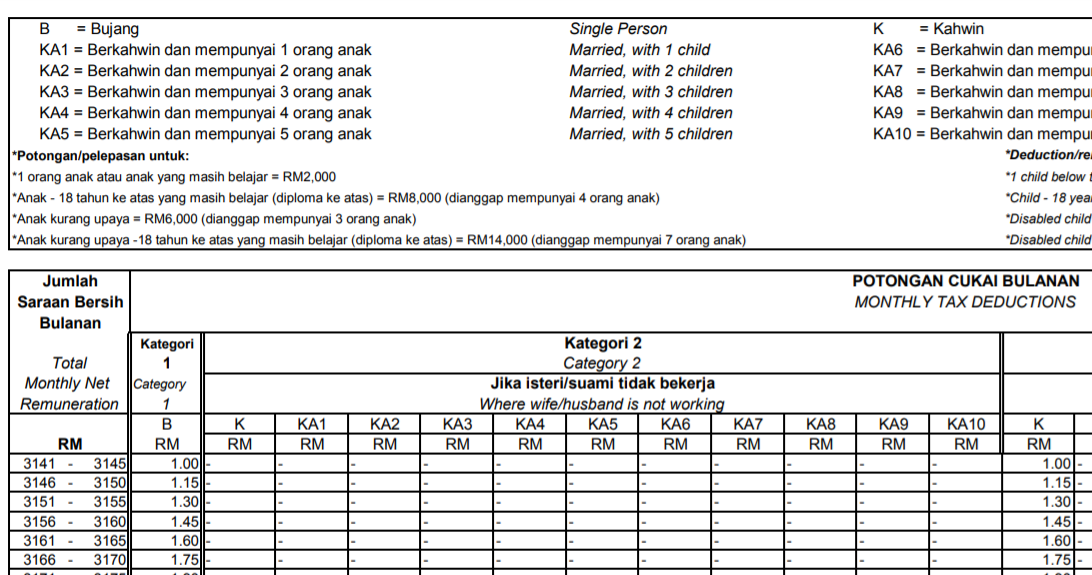

Other than pensionable public servant category life insurance premium restricted to rm3 000 contribution to epf approved scheme restricted to rm4 000 7 000 restricted 19. Any resident individual or huf can claim 80c deduction upto rs 1 5 lakh. This part consists of both monthly epf contribution and life insurance premium paid. Some made the silly mistake thinking this is applicable to insurance premium only.

However note that if you work in an organization where the number of employees is less than 20 then under the rules of the rules of the employees provident fund organization epfo the body which manages the scheme the contribution of both the employee and the employer is restricted to 10. Up to rm3 000 for life insurance and up to rm4 000 for epf. Who can claim deductions under section 80c of the income tax act 1961. You should not ignore this part due to the huge sum of tax relief allowed.

Life insurance and epf including not through salary deduction i. Deferred annuity and private retirement scheme prs with effect from year assessment 2012 until year assessment 2021. Life insurance and epf including not through salary deduction pensionable public servant category life insurance premium. Liam president anusha thavarajah said on friday the insurance body supported the separation into rm4 000 for epf and rm3 000 for life insurance takaful.

Rm 6000 both for combined assessment or each for separate assessment medical insurance 1. Insurance premium for education or medical benefit including not through salary deduction. F16 life insurance and provident fund limited to rm6 000. If your medical insurance is a standalone policy you can claim up to 100 of your total premium paid under the medical benefit category.

Life insurance and epf including not through salary deduction up to rm7 000 limited working adults who are making epf contributions should pay attention to this tax relief item as you can claim up to a whopping rm4 000 for epf and rm3 000 for life insurance or takaful. The employee makes an equal contribution.